Charting a New Course: U.S. Shipbuilding Analysis and Strategic Outlook

Executive Summary: The U.S. shipbuilding industry, a vital aspect of national security and a critical enabler of the maritime supply chain, finds itself at a strategic crossroads. While the nation's defense shipbuilding sector continues to deliver technologically advanced naval capabilities, its commercial counterpart has experienced a prolonged contraction in global market presence. This analysis delves into the multifaceted currents shaping American shipbuilding today, offering a clear-eyed assessment of its commercial and defense segments. We benchmark U.S. capabilities against global shipbuilding powerhouses—China, South Korea, Japan, and key European nations—to identify competitive disparities and opportunities. For supply chain and manufacturing professionals, a nuanced understanding of this evolving landscape is indispensable for anticipating shifts in maritime logistics, critical component sourcing, and the broader industrial base. We will explore a multi-dimensional strategic outlook for the industry's revitalization, focusing on leveraging targeted policy, spearheading innovation in green shipping and advanced manufacturing, cultivating a next-generation workforce, and fortifying the domestic supply chain through robust collaborative frameworks. The path forward demands strategic foresight and decisive action to ensure the U.S. can navigate the complexities of the modern maritime era.

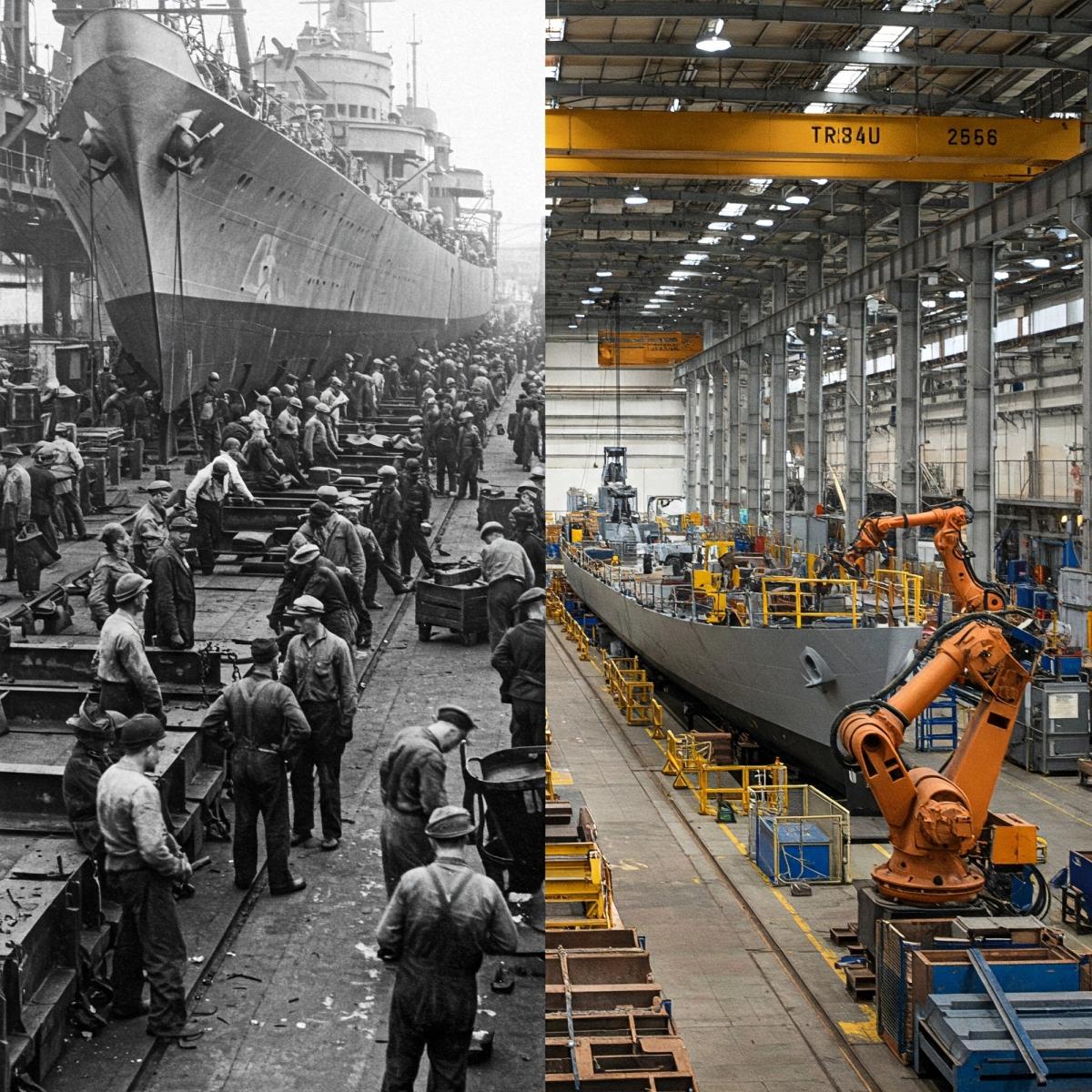

The Dual Realities of American Shipbuilding: Defense Prowess Amidst Commercial Challenges

The American shipbuilding story today is one of divergence. On one hand, the U.S. defense shipbuilding sector stands as an undisputed global leader in producing some of the world's most technologically sophisticated naval assets, including aircraft carriers, nuclear submarines, and advanced destroyers. This segment is foundational to U.S. national security strategy and power projection, operating primarily through substantial government contracts. Yet, it is not immune to headwinds, frequently contending with significant schedule delays, cost overruns, and persistent challenges in workforce recruitment, retention, and supply chain stability.

The commercial shipbuilding sector, in stark contrast, faces a more challenging horizon. Once a dominant force, its share of the global market for large oceangoing vessels has eroded to a mere 0.1% to 0.13% by tonnage. The construction of large commercial ships is now minimal, with recent years seeing only approximately 1 to 5 such vessels delivered annually, primarily to serve the Jones Act domestic fleet. The sector's existing capabilities are concentrated in smaller, niche vessel types such as Offshore Supply Vessels (OSVs), ferries, and tugboats, catering mainly to domestic requirements. Fundamental obstacles include high domestic production costs, limited economies of scale when compared to international mega-yards, and relentless competition from highly efficient and often heavily subsidized foreign shipbuilders, particularly in Asia. The Maintenance, Repair, and Overhaul (MRO) sector, though crucial for both naval and commercial fleet readiness, operates within this same challenging ecosystem. Globally, the maritime vessel MRO market was valued at an estimated $12.83 billion in 2023, projected to grow to $22 billion by 2032. The broader global boat and ship MRO market reached an estimated $118.91 billion in 2024. The U.S. Navy's own annual MRO budget is substantial, estimated between $6 billion and $7.4 billion, highlighting the critical need for efficient repair and sustainment capabilities.

Figure 1: U.S. Commercial vs. Defense Shipbuilding Snapshot

- Key Takeaway: The U.S. shipbuilding landscape is characterized by a world-leading, technologically advanced defense sector facing efficiency hurdles, and a commercial sector that has largely retreated from the global large vessel market to focus on domestic niches.

Figure 2: U.S. Production of Large Oceangoing Commercial Ships (Jones Act Fleet)

- Key Takeaway: The extremely low annual production rate of large U.S.-built commercial ships underscores the diminished capacity of the domestic industry to supply vessels for even its protected Jones Act trade, highlighting a critical challenge for fleet recapitalization.

Navigating the Headwinds: Key Challenges Testing U.S. Shipbuilding Resilience

To chart a new course, it's essential to first acknowledge the significant headwinds the U.S. shipbuilding industry must navigate. These are not fleeting squalls but deep-seated structural issues requiring strategic, long-term solutions.

- The Labor Cost and Workforce Equation: It's no secret that U.S. shipbuilding labor costs stand significantly higher than those in the dominant Asian shipbuilding nations. This fundamental cost differential impacts global competitiveness. Beyond cost, the industry grapples with a persistent and well-documented shortage of skilled tradespeople and experienced naval engineers. While initiatives such as the U.S. Navy's Talent Pipeline Program (TPP), which facilitated over 9,550 hires and partnered with over 450 employers, and broader Navy-supported efforts that recruited/trained over 12,600 individuals in 2024, are making inroads, the scale of the challenge remains substantial. As of May 2023, the entire U.S. Ship and Boat Building sector (NAICS 336600) employed approximately 153,000 individuals. A deeper look at historical employment trends over the past decade would reveal the cyclical nature and long-term pressures on this workforce.

- U.S. Ship and Boat Building Employment (NAICS 336600): 153,000 (May 2023).

- Source: Bureau of Labor Statistics (BLS), Current Employment Statistics (CES) & Occupational Employment and Wage Statistics (OEWS).

- Key Takeaway: The May 2023 employment figure provides a baseline; however, a full analysis of the 10-year trend (requiring detailed BLS data retrieval) is crucial to understanding the long-term workforce dynamics and the efficacy of talent development initiatives.

- The Jones Act: A Divisive Current: The Merchant Marine Act of 1920, commonly known as the Jones Act, remains a pillar of U.S. maritime policy, mandating U.S.-built, -owned, and -crewed vessels for all domestic waterborne commerce. Its proponents champion its role in preserving a domestic industrial base and ensuring a reserve of ships and mariners for national emergencies. Conversely, critics highlight its contribution to increased domestic shipping costs—with economic analyses by groups such as the Cato Institute and even government bodies like the Federal Reserve Bank of New York pointing to substantially higher expenses for regions like Puerto Rico and Hawaii compared to international shipping routes (with one study estimating annual costs of $1.5 billion for Puerto Rico and $1.2 billion for Hawaii). They argue it may also inadvertently limit the competitiveness and scale of U.S. commercial shipbuilding on the global stage. This ongoing debate shapes investment decisions and the overall operating environment.

- The Global Competitive Gauntlet: The international shipbuilding arena is fiercely competitive. East Asian nations—China, South Korea, and Japan—collectively dominate global output and new orders. China, in particular, has emerged as the undisputed heavyweight, leveraging a potent combination of extensive state subsidies (with estimates such as $132 billion in direct subsidies from 2010-2018 to state firms), strategic long-term industrial policies, significant R&D investments, and a "military-civil fusion" approach where commercial advancements readily benefit naval capabilities. This state-capitalist model presents a formidable challenge to U.S. shipyards operating in a different economic framework.

- Investment & Modernization Deficit: While the U.S. defense shipbuilding sector benefits from consistent, albeit often scrutinized, government capital investment, the commercial shipbuilding sector has, by and large, seen underinvestment in facility modernization and the widespread adoption of advanced manufacturing technologies when benchmarked against leading international shipyards. Bridging this technological and infrastructure gap is essential for improving productivity and cost-efficiency.

The Global Shipbuilding Stage: Benchmarking Against the Leaders

A clear understanding of the competitive landscape is paramount. The global shipbuilding market is largely a story of East Asian ascendancy, with European yards carving out specialized, high-value niches.

Figure 3: Global Shipbuilding Market Snapshot (CGT & GT, 2023/2024)

- Sources: Clarksons Research (for 2024 Output CGT and China/SK New Order CGT), UNCTAD Review of Maritime Transport 2024 (for 2023 Delivery GT shares and overall market context), various industry analyses.

- Key Takeaway: China and South Korea dominate both new shipbuilding orders and global output. Japan and Europe maintain smaller but significant output shares, particularly in specialized segments, while the U.S. share in large commercial vessel construction remains minimal, highlighting the competitive concentration in Asia.

Figure 4: Global Shipbuilding Output Share by CGT (2024)

- Key Takeaway: Global shipbuilding output is heavily concentrated in Asia, with China alone accounting for over half of the world's production by CGT in 2024, followed by South Korea and Japan.

Figure 5: New Commercial Ship Orders by Top Countries vs. U.S. (CGT, 2024)

- Key Takeaway: The immense scale of China's new commercial ship orders in 2024 underscores its market dominance, significantly outpacing South Korea, while U.S. orders for large commercial vessels remain comparatively insignificant.

East Asian Maritime Titans: China, South Korea, and Japan

- China's Commanding Presence: Beijing's strategic imperative to lead in the maritime domain is backed by substantial action. In 2024, Chinese shipyards secured approximately 68-70% of all new global orders by Compensated Gross Tonnage (CGT) and accounted for 53% of global shipbuilding output by CGT. This dominance extends across most major vessel types, including an astounding 90% of new container ship orders, 81% of dry-bulk ships, and 72% of tankers by late 2024. Even in complex segments such as LNG carriers, China held half of new gas carrier orders. This rapid ascent is fueled by significant state subsidies (estimated at $132 billion for state firms from 2010-2018), a clear industrial strategy that includes "military-civil fusion," extensive R&D investment, and aggressive capacity expansion. The ability to deliver a wide array of vessels, now including domestically built cruise ships such as the Adora Magic City, at competitive prices is a key advantage.

- South Korea's High-Tech Edge: South Korea remains a formidable force, particularly in high-value, technologically complex vessels. It captured around 17% of new global orders by CGT in 2024 and contributed 28% to global output. Korean yards are world leaders in the construction of LNG and LPG carriers, very large crude carriers (VLCCs), and are increasingly pivotal in the development of eco-ships. A defining strategy is substantial investment in R&D, with the government and industry committing $1.8 billion in 2025 towards next-generation ship technologies, focusing on green shipping (ammonia-powered ships, electric propulsion) and digital transformation (AI-driven automation).

- Japan's Quality and Niche Focus: Japan, contributing 12% to global output by CGT in 2024 (with 2023 delivery GT share at 15.4% per UNCTAD), pursues a strategy centered on high-specification, quality-driven, and environmentally advanced vessels. Strengths include technologically sophisticated bulk carriers, vehicle carriers, and a strong push towards "eco-ships" utilizing innovations such as solar power and air lubrication. Japan is investing heavily (over $770 million in 16 government-backed projects) in zero-emission ship technologies (ammonia, hydrogen, advanced LNG fuel tanks), aiming to introduce its first-generation zero-emission commercial vessels by 2028 and achieve a "top share in orders for next-generation ships in 2030."

Figure 6: Strengths and Specializations of Major Shipbuilding Nations

- Key Takeaway: Global shipbuilding leadership is concentrated, with each major player leveraging distinct strategic advantages—China's scale and state support, South Korea's technological dominance in high-value segments, Japan's quality and eco-innovation focus, and Europe's unparalleled expertise in complex, bespoke vessels.

European Expertise: Masters of Complexity and Niche Markets

European shipbuilding, while smaller in overall global output (around 4% by CGT in 2024, with a 2.5% delivery GT share in 2023 per UNCTAD), excels in market segments demanding intricate design, advanced systems integration, and high customization. Nations such as Italy (Fincantieri), Germany (Meyer Werft), France (Chantiers de l'Atlantique, Naval Group), and the Netherlands (Damen) are renowned for producing the world's most sophisticated cruise ships, mega-yachts, complex offshore support vessels, advanced dredgers, and specialized naval platforms. Their competitive strength lies in deep engineering expertise, a robust marine equipment supplier network (EUROYARDS members), and a long tradition of innovation in high-value, non-standardized shipbuilding projects.

Policy Tides: Navigating U.S. Maritime Legislation and Initiatives

The trajectory of U.S. shipbuilding is inextricably linked to a framework of foundational laws and emerging policy initiatives designed to shape its future. For supply chain and manufacturing professionals, understanding these policy currents is vital for anticipating market shifts and investment climates.

The Jones Act: An Enduring Debate with Far-Reaching Implications

The Merchant Marine Act of 1920, commonly known as the Jones Act, remains a cornerstone of U.S. maritime policy. It mandates that all goods transported by water between U.S. ports must be carried on vessels that are U.S.-built, U.S.-owned, U.S.-flagged, and U.S.-crewed.

- Arguments in Favor: Proponents emphasize the Act's role in maintaining a domestic shipbuilding industrial base, preserving a pool of American mariners crucial for national security and economic stability, and ensuring reliable domestic shipping services. They argue it supports thousands of American jobs and contributes to the U.S. economy.

- Arguments Against & Criticisms: Critics, including organizations such as the Cato Institute and studies from entities like the Federal Reserve Bank of New York, contend that the Jones Act significantly inflates transportation costs for domestic waterborne commerce. This is particularly acute for non-contiguous states and territories such as Hawaii, Alaska, and Puerto Rico (with one study estimating annual costs of $1.5 billion for Puerto Rico and $1.2 billion for Hawaii). Detractors argue it limits competition, potentially hinders the modernization and efficiency of the domestic fleet, and has not prevented the steep decline of U.S. commercial shipbuilding in the global market for large, internationally trading vessels. The high cost of U.S.-built ships compared to foreign alternatives is a central point of contention.

New Legislative & Executive Impetus: SHIPS Act and Revitalization Orders

A recent surge in policy focus signals a concerted effort to revitalize the U.S. maritime sector. The proposed "Shipbuilding and Harbor Infrastructure for Prosperity and Security (SHIPS) for America Act of 2025" is a comprehensive legislative effort aimed at bolstering the U.S. Merchant Marine and the domestic shipbuilding industrial base. Key provisions include:

- Shipbuilding Financial Incentives Program: To directly stimulate the construction, repowering, and reconstruction of eligible oceangoing vessels in U.S. shipyards.

- National Shipbuilding Research Program: To foster innovation and accelerate the development of next-generation shipbuilding technologies.

- Workforce Development: Establishing Centers of Excellence for maritime training, a Maritime Career and Technical Education Advisory Committee, a Public Service Loan Forgiveness program for mariners, and a Student Incentive Payment Program for state maritime academies.

- Maritime Security Enhancements: Creation of a Tanker Security Program and a Maritime Security Trust Fund to provide sustained federal support.

- Tax Incentives: A proposed 25% tax credit for investment in qualifying domestic shipyard facilities and a 33% tax credit for investment in the construction, repowering, or reconstruction of eligible U.S.-flagged oceangoing vessels.

- Title XI Program Modernization: Conversion of the existing Title XI Federal Ship Financing Program into a revolving fund to enhance its sustainability and impact.

Complementing legislative efforts, an April 2025 Executive Order on "Restoring America's Maritime Dominance" further aims to address structural vulnerabilities. This order directs a whole-of-government approach, including:

- Leveraging the Defense Production Act to support the industrial base.

- Establishing public-private incentives and the Shipbuilding Financial Incentives Program.

- Expanding workforce training programs and modernizing the U.S. Merchant Marine Academy.

- Considering service fees on certain PRC-built or -operated vessels entering U.S. ports (e.g., up to $1M-$1.5M per vessel/entrance).

- Directing changes to the collection of the Harbor Maintenance Fee (HMF) to address cargo diversions to Canadian/Mexican ports.

The MARAD Title XI Program itself remains a key existing mechanism, providing federal loan guarantees for vessel construction and shipyard modernization projects that meet criteria of economic soundness and project feasibility, aiming to promote growth, job creation, and the adoption of emerging technologies, including environmental advancements.

Figure 7: Overview of Key U.S. Policy Initiatives for Shipbuilding

- Key Takeaway: The U.S. is actively exploring and implementing a range of policy measures, from long-standing laws such as the Jones Act to new legislative proposals (SHIPS Act) and executive actions. These aim to revitalize its domestic shipbuilding capacity, enhance maritime security, and improve global competitiveness through financial incentives, R&D support, and workforce development.

Winds of Change: Technological Transformation Reshaping the Seas

For the U.S. shipbuilding industry to regain momentum, embracing technological transformation is not merely an option but an imperative. Supply chain and manufacturing professionals should closely monitor advancements in smart shipyards and green shipping, as these will define the next era of maritime operations.

The Ascent of Smart Shipyards: Advanced Manufacturing & Digitalization

The global paradigm is shifting towards "smart shipyards," where digitalization and advanced manufacturing converge to elevate efficiency, quality, and safety standards. This revolution encompasses:

- Robotics and Automation: From automated welding and robotic cranes to Automated Guided Vehicles (AGVs) for material transport, automation is key to enhancing precision and addressing skilled labor shortages.

- Artificial Intelligence (AI): AI algorithms are being deployed for tasks such as predictive maintenance, optimizing production schedules, and improving the accuracy of weld inspections.

- Digital Twins: Creating virtual replicas of ships and shipyard processes allows for real-time monitoring, scenario simulation, predictive maintenance, and optimized workflow planning before steel is even cut.

- Industrial Internet of Things (IIoT): A network of interconnected sensors and systems provides comprehensive data on equipment performance, material flow, and overall operational status, enabling data-driven decision-making.

- Augmented Reality (AR) & Virtual Reality (VR): These technologies are transforming training, enabling complex assembly guidance, and facilitating remote collaboration and inspections.

- Blockchain Technology: Enhancing supply chain transparency and security, particularly for tracking critical components and materials.

The adoption of these technologies directly translates into tangible benefits: increased productivity, reduced lead times, lower defect rates, enhanced worker safety, and ultimately, improved cost-competitiveness. The global market for Digital Shipyards underscores this trend, valued at US$2.2 billion in 2024 and projected to reach US$6.4 billion by 2030. The U.S. market segment was estimated at $613.3 million in 2024. For U.S. yards, strategic investment in these areas is fundamental to closing the efficiency gap with leading global players.

Figure 8: Digital Shipyard Technologies & Market Outlook

- Key Takeaway: Smart shipyard technologies are pivotal for enhancing productivity, quality, and cost-effectiveness. The significant projected market growth underscores their importance, and strategic adoption by U.S. shipbuilders is critical for future competitiveness.

The Green Shipping Imperative: Navigating Towards Sustainable Maritime Solutions

The global maritime industry is charting a course towards decarbonization, driven by increasingly stringent environmental regulations such as the International Maritime Organization's (IMO) target for net-zero greenhouse gas (GHG) emissions by or around 2050 and regional policies such as the EU's FuelEU Maritime initiative. This transition presents both formidable challenges and substantial opportunities for U.S. shipbuilding.

- The Rise of Alternative Fuels: The industry is witnessing a decisive shift in fuel choices for newbuilds.

- LNG (Liquefied Natural Gas): Currently the most adopted transitional fuel, offering immediate emission reductions. The OECD noted that LNG-capable vessels constituted approximately 37% of the alternative-fuel-capable global newbuild orderbook by gross tonnage.

- Methanol: Gaining significant traction as a viable near-term option, accounting for about 9.7% of the alternative-fuel-capable orderbook (GT).

- Ammonia: Viewed as a promising long-term zero-carbon fuel, though its adoption is in earlier stages, representing around 0.55% of the alternative-fuel-capable orderbook (GT).

- Hydrogen & Biofuels: Also part of the future fuel mix, with ongoing R&D and pilot projects. Collectively, over 52% of the global newbuild orderbook by gross tonnage is now designed to be alternative fuel capable. However, only around 7% of the existing global fleet can operate with these technologies, highlighting the scale of the fleet renewal challenge.

- Global Leadership & U.S. Opportunities: East Asian shipyards, particularly in China and South Korea, are at the forefront of constructing vessels capable of running on these new fuels (China: 47% of alt-fuel orderbook by CGT; South Korea: 42% - OECD data). European engine designers, however, are key enablers, supplying over 65% of the alternative fuel-capable fleet and orderbook. For the U.S. to carve out a niche in green shipbuilding, significant investment in R&D, specialized shipyard capabilities, and supportive infrastructure (e.g., bunkering for ammonia and methanol, where U.S. availability is currently limited) will be essential. The U.S. Department of Transportation's "Decarbonizing the Maritime Shipping Industry" action plan and initiatives such as "Green Shipping Corridors" indicate strategic intent but require robust implementation and funding.

- Autonomous Shipping as a Complementary Advance: Alongside green technologies, autonomous shipping offers potential for efficiency gains and reduced operational costs. The U.S. is making strides here, exemplified by DARPA's No Manning Required Ship (NOMARS) program and its USX-1 Defiant prototype, which completed construction in February 2025 and was slated for extended testing.

Figure 9: Alt-Fuels used in Vessels (Orderbook% by CGT)

- Key Takeaway: The global shipbuilding orderbook reflects a decisive shift towards sustainability, with over half of new vessels by gross tonnage being alternative fuel capable. LNG leads as a transitional choice, while methanol and ammonia are emerging as critical future fuels, signaling a major technological pivot for the industry.

Figure 10: Leading Nations Building Alt-Fuel Vessels (Orderbook% by CGT)

- Key Takeaway: China and South Korea are overwhelmingly dominant in constructing the current global orderbook for alternative fuel-capable vessels, highlighting their strategic positioning and early manufacturing lead in the green shipping transition.

Data Point for European Engine Designers:

“European engine designers supply over 65% of the alternative fuel capable fleet and orderbook.”

- Source: OECD, "The Role of Shipbuilding in Maritime Decarbonisation".

- Key Takeaway: While Asian yards lead in the construction of alternative-fuel ships, European technological expertise in advanced engine design remains critical in providing the propulsion systems necessary for the global green shipping transition.

Manning the Future: Cultivating a Skilled Workforce and Resilient Supply Base

The revitalization of American shipbuilding hinges critically on two human and industrial factors: a highly skilled, next-generation workforce and a robust, responsive domestic supply chain. For manufacturing and supply chain professionals, developments in these areas signal both challenges in terms of labor availability and opportunities in component supply.

Workforce Development: The Human Capital Imperative

The U.S. Ship and Boat Building sector (NAICS 336600) provided employment for approximately 153,000 individuals as of May 2023 (BLS OEWS data). However, attracting, developing, and retaining the necessary talent, from skilled trades such as welding and pipefitting to advanced engineering and digital systems expertise, remains a persistent challenge exacerbated by an aging workforce demographic across skilled trades and intense competition for talent from other industries. Strategic imperatives to address this include:

- Strategic Partnerships & Pipeline Creation: Deepening collaborations between shipyards, community colleges, vocational schools, and technical training institutions (e.g., Navy's partnership with Accelerated Training in Defense Manufacturing program, Dept. of Labor's Job Corps).

- Targeted Recruitment & Enhanced Industry Image: Proactive campaigns to showcase the technologically advanced nature of modern shipbuilding and its contribution to national and economic security, coupled with focused initiatives to improve diversity and inclusion by attracting more women, minorities, and veterans into maritime careers.

- Comprehensive Retention Programs: Moving beyond competitive wages to incorporate clear career progression pathways, opportunities for continuous learning and professional development, and fostering a positive, safe, and supportive work environment (e.g., Navy contract incentives for childcare and housing).

- Training for Future Technologies: Ensuring the workforce is proficient in operating and maintaining advanced manufacturing systems, working with digital tools, and handling new materials and sustainable fuel systems.

The U.S. Navy's Maritime Industrial Base (MIB) Program and its integrated Talent Pipeline Program (TPP) exemplify efforts in this domain. The TPP, for instance, has reportedly facilitated over 9,550 hires since its inception and partnered with more than 450 employers. In 2024 alone, broader Navy-supported industry efforts aimed to recruit, train, and retain over 12,600 employees in critical shipbuilding trades and engineering fields.

- U.S. Ship and Boat Building Employment (NAICS 336600): 153,000 (May 2023).

- Source: Bureau of Labor Statistics (BLS), Occupational Employment and Wage Statistics (OEWS).

- Key Takeaway: The May 2023 employment figure provides a baseline; however, a comprehensive understanding of the workforce's trajectory over the past decade and the true impact of revitalization efforts requires detailed historical trend analysis from BLS Current Employment Statistics.

Fortifying the Domestic Supply Chain: The Role of the MIB Program

A resilient, responsive, and technologically capable domestic supply chain is the bedrock of an effective shipbuilding industry. Over-reliance on foreign sources for critical components—from specialized steel and propulsion systems to advanced electronics—can introduce significant vulnerabilities related to geopolitical instability, logistical disruptions, and quality control. The U.S. Navy's Maritime Industrial Base (MIB) Program is a pivotal initiative designed to mitigate these risks by:

- Strategic Supplier Development: Investing significantly to bolster the capabilities, capacity, and technological sophistication of domestic suppliers. Since FY2018, the Navy has launched over 725 targeted supplier development projects with more than 300 suppliers across 33 states. These initiatives include efforts such as developing alternate domestic sources for critical components previously single-sourced or foreign-sourced, and improving the performance and throughput of companies supplying sequence-critical materials essential for maintaining new construction schedules.

- Investment Focus: Over $1 billion has been invested since FY2018 to improve the performance of these critical material suppliers. The broader MIB program encompasses over 1,100 investment initiatives across 37 states, aiming to create a more robust and diversified supplier network capable of meeting the Navy's expanding shipbuilding and sustainment demands. While specific project examples are often sensitive, the focus is on enhancing capability, capacity, and overall resilience within the multi-tiered supplier network.

The Critical MRO Sector: Sustaining Fleet Readiness and Commercial Viability

The Maintenance, Repair, and Overhaul (MRO) sector is indispensable not only for ensuring the operational availability and longevity of naval fleets but also for supporting the commercial maritime industry.

- Naval MRO Dynamics: The U.S. Navy allocates a substantial annual budget, estimated between $6 billion and $7.4 billion, for MRO activities. However, reports from the Government Accountability Office (GAO) have consistently highlighted systemic challenges, including persistent maintenance delays, significant cost overruns at both public and private shipyards, critical limitations in shipyard infrastructure and skilled workforce capacity, and issues with the Navy's own workload planning and contract management. These factors directly impact fleet readiness and operational tempo, leading to ongoing discussions about optimizing MRO strategies, including the potential for leveraging allied MRO capabilities.

- Commercial MRO Market & U.S. Context: The global boat and ship MRO market is a major industry, valued at $118.91 billion in 2024 and projected to grow to $125.20 billion in 2025 and $160.28 billion by 2030 (CAGR of 5.10%). For the U.S. commercial MRO sector, developments such as proposed tariffs on imported steel and marine components could create a more favorable environment for domestic repair yards, assuming they possess the capacity and efficiency to handle increased demand. Conversely, U.S.-based vessel operators might face higher MRO costs, further incentivizing investments in predictive maintenance technologies and efficient lifecycle management.

Figure 11: Global MRO Market Size & Projections

- Key Takeaway: The global MRO market represents a significant and growing sector. While U.S. naval MRO faces efficiency challenges, the broader commercial MRO landscape presents both opportunities and cost pressures for U.S. interests, influenced by trade policies and domestic capacity.

U.S. Navy MRO Budget:

- Estimated Annual U.S. Navy MRO Budget: $6 billion - $7.4 billion (Source: U.S. Government Accountability Office (GAO) reports, industry analyses).

- Key Takeaway: The substantial annual U.S. Navy MRO budget underscores the critical financial commitment to fleet sustainment, even as the sector grapples with challenges in efficiency and capacity that impact overall naval readiness.

Charting the New Course: A Multi-Pillar Strategy for U.S. Shipbuilding Revitalization

Revitalizing the U.S. shipbuilding industry—enhancing its commercial viability while sustaining its defense capabilities—demands a cohesive, forward-looking national strategy. This isn't about finding a single silver bullet but rather orchestrating a series of synchronized efforts across multiple strategic pillars. The framework for such a strategy is outlined in U.S. law (46 U.S.C. 50114), emphasizing a whole-of-government approach, competitiveness, capability enhancement, infrastructure investment, workforce development, and resilience. Drawing from our analysis, the path forward crystallizes around the following imperatives:

Figure 12: Key Pillars of U.S. Shipbuilding Revitalization Strategy

- Key Takeaway: A successful and lasting revitalization of U.S. shipbuilding necessitates a holistic, multi-decade national commitment. This strategy must seamlessly integrate smart, consistent policy and robust investment with aggressive technological innovation, a profound focus on rebuilding the skilled workforce and domestic supply base, and the pragmatic leveraging of both dynamic public-private partnerships and strategic international collaborations where advantageous.

A Forward View for Supply Chain & Manufacturing Professionals

The voyage to rebuild and modernize the U.S. shipbuilding industry will undoubtedly be a long and complex one, requiring sustained commitment and strategic adaptation. For professionals operating within the broader supply chain and manufacturing ecosystems, the implications of this journey are multifaceted and significant. A more robust and technologically advanced domestic shipbuilding sector can translate into increased demand for a wide array of U.S.-manufactured components, from raw materials and basic fabrications to highly specialized propulsion systems and advanced electronics. It can foster new opportunities for domestic firms specializing in advanced materials, automation, digital solutions, and green technologies.

A revitalized U.S.-flagged fleet, potentially incorporating more efficient and environmentally friendly vessels, could offer new, more resilient domestic and international shipping options, impacting logistics strategies. The innovations spurred by the drive to modernize shipyards and vessels—particularly in green fuels, autonomous operations, and advanced digital manufacturing processes—are likely to have positive spillover effects, creating new standards, capabilities, and competitive opportunities across the entire U.S. industrial landscape. Therefore, staying keenly attuned to these policy shifts, technological advancements, workforce development initiatives, and evolving supply chain dynamics will be key to navigating and capitalizing on the emerging opportunities within the U.S. maritime domain.

About Partsimony

Partsimony helps OEMs scale faster with fewer resources by building adaptive manufacturing supply chains that provide a decisive competitive edge.

To get more done faster and with fewer resources, reach out to solutions@partsimony.com.

-------

This analysis draws from comprehensive research on the maritime ecosystem, global supply chain dynamics, manufacturing requirements, policy considerations, and trends. For specific questions related to your organization's drone manufacturing or sourcing strategy, reach out to us at solutions@partsimony.com.

Rich Mokuolu

Supply Chain Strategist

Stay Updated

Get the latest insights on supply chain innovation and hardware development.